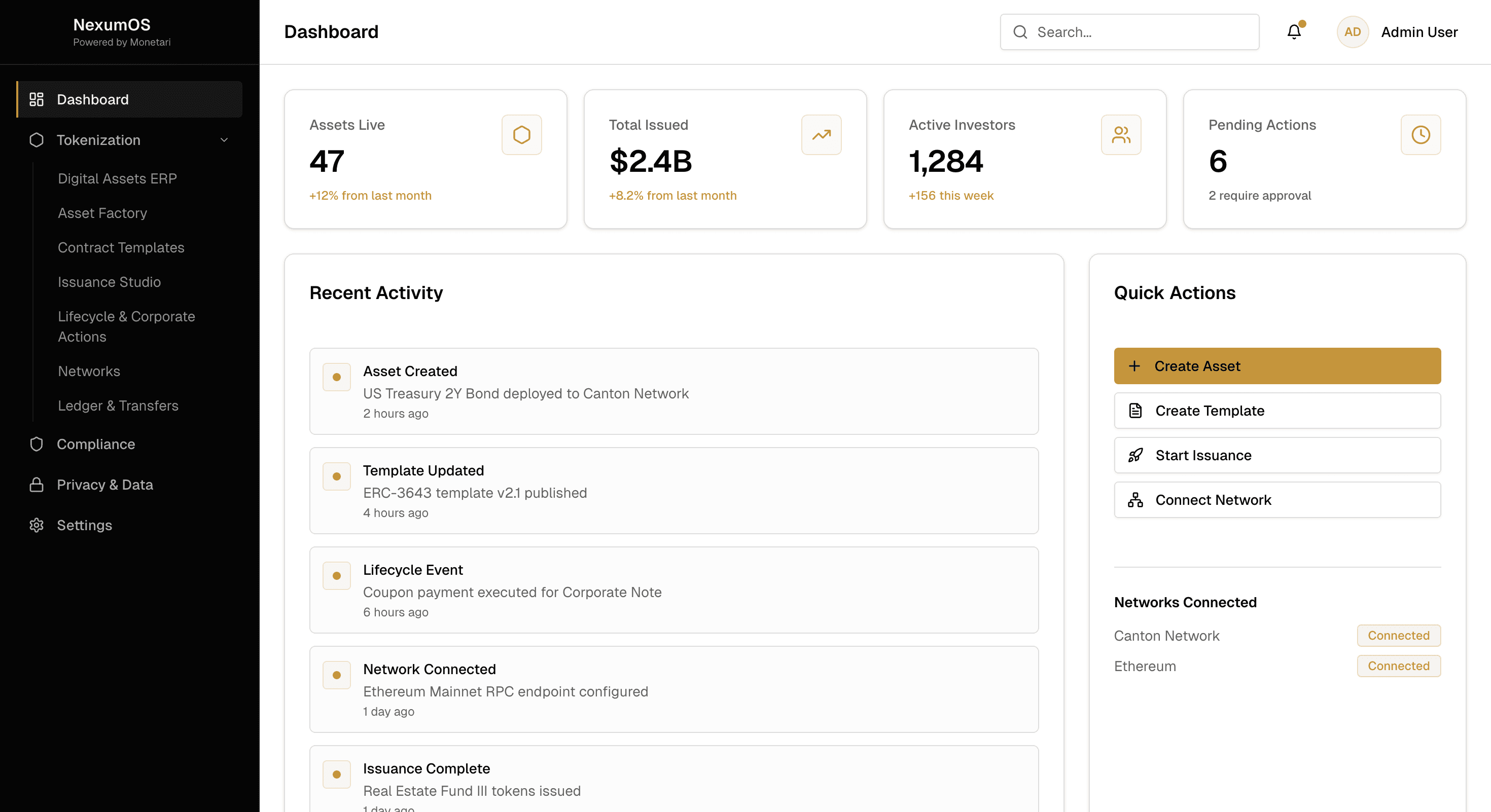

The Operating System for Digital Capital Markets.

Nexum OS bridges the gap between your Core Banking System and the Global Digital Asset Ecosystem. Enable atomic settlement, tokenized assets, and collateral mobility.

Schedule a Demo

Digital Assets ERP

Suited for Institutions

Nexum OS upgrades your existing back office, quietly syncing your databases with the blockchain in real time.

Trigger Settlement Mechanism

Cash stays in the bank account (off-chain), while the asset moves on the blockchain (on-chain), synchronized by our atomic triggers.

Zero Disruption

No need to migrate data or change your accounting software. Nexum plugs into your existing APIs (Rest/Soap) and starts orchestrating immediately.

The Asset Factory

Asset Factory

Create and manage digital assets

Bond Template

Pre-audited bond template

Sukuk Template

Pre-audited sukuk template

Fund Template

Pre-audited fund template

Smart Contract Templates

Stop writing code from scratch. Use our pre-audited templates for Bonds, Sukuk, and Funds.

Representative Tokenization

From issuance to maturity (redemption), create "Digital Twins" of your assets. The token represents beneficial ownership.

Automated Lifecycle

Nexum OS automates interest calculations, daily price updates (rebasing), and coupon payments connected to your core banking.

Privacy & Data Sovereignty

In an era where data privacy is paramount, Nexum OS provides enterprise-grade security and compliance without compromising on functionality or performance.

Data Sovereignty

Built on private sub-blockchains, Nexum OS ensures your customer data (PII) never leaves your on-premise servers. You comply with data residency rules by design.

Sub-Transaction Privacy

Unlike standard blockchains where everyone sees every transaction, Nexum creates "private tunnels" for each trade. Your competitors will never know your liquidity position or customer list.

Regulatory Compliance

Designed with GDPR, CCPA, and regional data protection laws in mind. Automated compliance checks ensure your operations meet regulatory requirements without manual oversight.

Zero-Knowledge Architecture

Advanced cryptographic protocols allow transaction validation without exposing sensitive data. Verify without revealing—maintain complete privacy while ensuring trust.

Ready to Transform Your Digital Capital Markets?

Contact our team to discuss how Nexum OS can bridge your Core Banking System with the Global Digital Asset Ecosystem

Schedule a Demo